》View SMM Copper Quotes, Data, and Market Analysis

》Subscribe to View SMM Historical Spot Metal Prices

》Click to View SMM Copper Industry Chain Database

The 2025 Chinese New Year holiday is from January 28 to February 4, during which the SHFE market will be closed. Before the holiday, the SHFE copper 2503 contract fluctuated downward, closing at 75,540 yuan/mt on January 27.

In the overseas market, LME copper prices were pressured by the continuously rising US dollar index during the week before the Chinese New Year (January 21-27), briefly dipping to $8,914/mt, significantly pulling back from the pre-holiday high of $9,355/mt. It eventually closed at $9,153/mt, down 0.83% from the opening price of $9,230/mt on January 27.

Macro Perspective:

Overseas risks focus on "policy conflicts," with expectations for US Fed interest rate cuts further cooling.

In December, the US added 256,000 non-farm jobs (expected 160,000), with data significantly exceeding expectations, reinforcing "inflation resilience." The market has reduced the expected number of US Fed rate cuts in 2025 to one, with the first cut postponed to Q4. The January FOMC statement removed the phrase "considering policy lags," suggesting the rate hike cycle may have ended, but the threshold for rate cuts remains very high.

The ECB's "hawkish rate cut" disrupted the market: Eurozone CPI in January rebounded YoY to 3.2% (expected 2.9%), with core CPI remaining high at 4.1% YoY. However, the ECB still announced a 25bp rate cut to 3.75%, mainly due to a 0.2% QoQ contraction in Q4 GDP, highlighting recessionary pressures. ECB President Lagarde stated that "rate cuts are not pre-set," and the market has narrowed the expected rate cuts for the year from four to two.

Trump's new policies impact the supply chain: On February 1, Trump signed an executive order imposing a 10% tariff on Chinese goods (affecting approximately $300 billion worth of goods) and a 25% tariff on automobiles from Canada and Mexico. US Treasury Secretary Besant stated that "reducing the deficit is a priority," raising market concerns about limited fiscal expansion space. The 10-year US Treasury yield rose, putting downward pressure on risk assets.

Domestic policies balance "stabilizing expectations" with geopolitical risks.Pre-holiday policy measures were weaker than expected: Following the Central Economic Work Conference, market expectations for "extraordinary stimulus" were unmet. Pre-holiday fiscal measures focused on issuing consumption vouchers and equipment upgrade subsidies, without addressing demand in the real estate chain.

In January, retail sales growth rebounded YoY to 5.1% (previous value 4.6%), but real estate sales area still declined 12% YoY, indicating that policy support effects have not yet transmitted to bulk commodities. The State Council announced a 15% tariff on US coal and LNG and a 10% tariff on crude oil and agricultural machinery starting February 10, potentially increasing domestic energy costs. Following the implementation of Trump's tariffs on Chinese goods, China stated it "will take necessary countermeasures." If US-China tensions escalate into the tech sector, market risk appetite could be impacted.

Fundamentals:

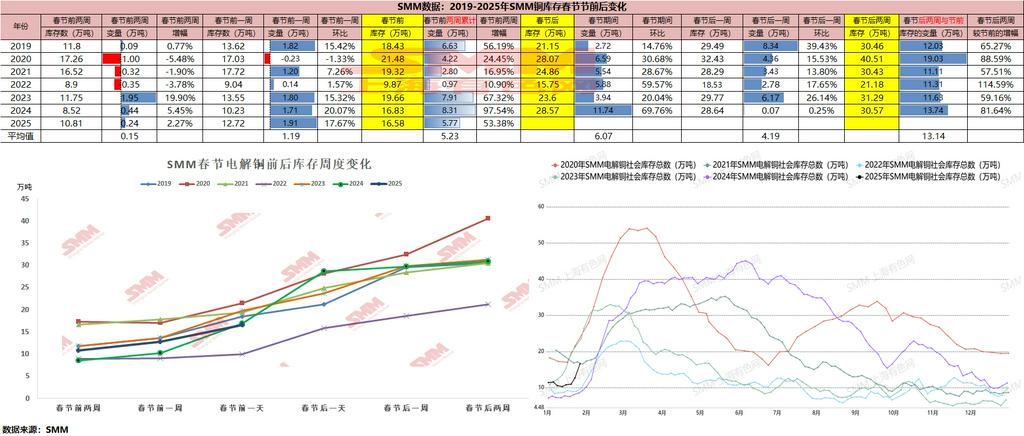

LME inventories saw a slight reduction before the Chinese New Year, with a price spread against COMEX's most-traded contract still present, increasing some traders' willingness to transfer to delivery warehouses. Domestic inventories remained low, but pre-holiday stockpiling sentiment was limited, with downstream consumption showing weakness. Bonded zone inventories also stayed low, and import losses narrowed. The increase in customs-cleared supply was limited. According to the SMM survey, copper cathode rod enterprises slightly increased pre-holiday stockpiling YoY, mainly due to the earlier timing of the Chinese New Year holiday and power grid orders placed in advance, supporting demand. However, wire and cable enterprises in the real estate chain saw a YoY decrease in days of raw material inventories, with end-use demand showing divergence.

Post-Holiday Outlook: Overseas bearish factors may pressure copper prices. High LME copper inventories and a strong US dollar (US Treasury yields + geopolitical hedging) could suppress LME copper's rebound. If the US Fed further signals hawkish policies, copper prices may test the $9,000/mt level.

Domestic policy expectations may provide support for the domestic market: Pre-Two Sessions "growth stabilization" policy debates are expected to intensify. In the spot market, increased domestic inventory buildup during the Chinese New Year may significantly suppress spot premiums, but caution is needed regarding potential short-term liquidity tightness caused by delayed arrivals of imported supplies.